What is a Business Legal Structure?

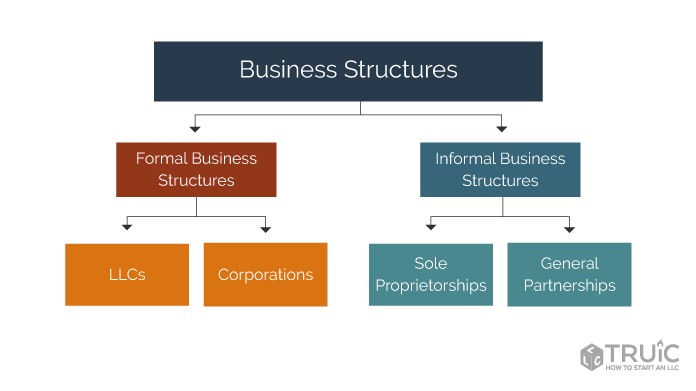

The government groups and rules over the different parts of a business based on its legal structure. The amount of paperwork and money that can be raised depends on the structure and state registration of the organization. Entities, business ownership structures, and business forms are all terms used to describe a company’s legal structure. There are 10 different ways to set up a company legally. Here are types of business legal structure:

- Sole Proprietorship

- Partnership

- Limited Liability Partnerships (LLP)

- Limited Liability Company (LLC)

- Series LLC

- C-corporation

- S-corporation

- Non-profit corporation

- Benefit corporation

- Low-profit limited liability company (L3C)

The most common Bedava Bonus business legal structures are:

- Sole Proprietorship

- Partnership

- Limited Liability Company (LLC)

- C-Corporation

- S-Corporation.

Types of Legal Business Structure.

1. Sole Proprietorship.

One of the 10 ways a business can be set up legally, the sole proprietorship is the easiest and most common. It is the easiest to set up and doesn’t cost too much. Most of the cost goes to paying licensing fees and taxes for the company.

Since there is only one person in charge of running the business, there is no need to make a difference between the owner and the business itself. Since there are no other partners, the owner is the only one responsible for the company’s debts and costs.

This gives them complete power over the business. For tax purposes, the treatment of a sole proprietorship is a single entity because its owner is also its only employee.

The ending is just as easy to understand as the beginning. If the owner wants to stop it, he can do so on his own, and he doesn’t need any official paperwork to do so.

2. Partnership.

A partnership is a type of business legal structure in which more than one person is a partner in the business. If you want to do business under a fake name in the state, you need a partnership agreement and a certificate.

In a formal partnership, the partnership agreement spells out who owns what and what each partner is responsible for. Depending on how much of the company each business partner owns, that person’s share of the company’s profits will vary.

There is also a lot of room for growth because banks are willing to lend money to business owners no matter what their past is like. Usually, the person’s income tax is also not paid. Instead, each owner must report on their own tax returns their fair share of the business’s profits and losses.

3. Limited Liability Partnership (LLP).

Limited Liability Partnership (LLP) is similar to the business legal structure ‘Partnership’. So, the only thing that can limit each partner’s liability is the amount of money they put into the business. Partners make a formal operating agreement and register it with the secretary of state.

4. Limited Liability Company (LLC).

The legal structure of a Limited Liability Company (LLC) is a mix of a sole proprietorship, a partnership, and a corporation. When there is a sign of an LLC operating agreement, it creates a separate legal entity.

Members refer to the people who run an LLC. Single-member LLC is when there is only one owner. Only the business, not its owners, is subject to legal action in the event of a lawsuit. Moreover, it depends on the owners how much control they would like to take over the company.

5. Series (LLC).

Series LLC is another unique type of limited liability company. Members can divide interests, assets, and operations in to as many series as they want, per its formation certificate. And each independent series works like its own thing, with its own name, bank account, books, and records.

In each series, the members and managers can be different, and so can their rights and duties. The most significant feature of Series LLC is the ability to hold individual strings accountable.

6. C-Corporation.

C-Corporation, also known as C-Corp, is another business legal structure. In this type, there is a separation of tax of the owners and the shareholders separately from the entity.

C-Corporations separate owners’ and shareholders’ assets and income from the corporation’s. Such agreements need to be submitted to NY Biennial Statement Online. Investors and business owners can only lose the amount of money they invested in the company if it fails.

7. S-Corporation.

For federal tax purposes, companies called “S-Corps” can choose to pass through to their shareholders all the company’s:

- Income

- Losses

- Depreciation costs

- Tax credits.

The term “Small Business Corporation” is an abbreviation for “Small Business Corporation.”

The only distinction between an S-Corp and a C-Corp pertains to the topic of “Taxes.” S corporations are exempt from corporate income tax because of this tax structure. On the other hand, taxes are paid at the level of the corporation when it comes to C-Corporations.

8. Organization Serving the Public Good

When a benefit business does well, it will send dividends to its shareholders, which are the people who own shares in the business. A benefit corporation’s primary goal is to serve a social cause, such as improving society or protecting the environment.

Managers can use their own judgment if they can balance their social responsibilities and the environment’s needs.

9. Benefit Corporation

The profits in a benefit corporation are distributed as dividends among the shareholders. Besides making money, a benefit corporation’s main goal is to help people or the environment in some way. Managers can balance social and environmental causes to achieve these goals.

10. Low-Profit Limited Liability Company

Low-Profit Limited Liability, also known as (L3C) for-profit LLC, is the last type of business legal structure on our list. It meets three requirements:

- The main goal of L3C is not to make money or increase the value of the property.

- It doesn’t have a goal of achieving one or more political or legislative goals.

It makes a big difference in reaching one or more charitable or educational goals, as defined by Section 170(c)(2)(b) of the Internal Revenue Code. For a company to exist, it had to make a significant impact on charitable or educational causes.